1997

Louis Dreyfus Group forms an energy merchant subsidiary.

CCI was formed in 1997 as a subsidiary of the Louis Dreyfus Group and became Louis Dreyfus Highbridge Energy LLC in 2006. Acquired in 2012 by a group of private investors and management, the company was renamed Castleton Commodities International LLC.

Louis Dreyfus Group forms an energy merchant subsidiary.

Highbridge Capital Management LLC makes a significant minority equity investment in the Louis Dreyfus Group’s energy merchant subsidiary, forming Louis Dreyfus Highbridge Energy LLC.

Louis Dreyfus Highbridge Energy monetizes its midstream energy asset portfolio.

Louis Dreyfus Highbridge Energy is acquired by management and a group of private investors. The newly established company is renamed Castleton Commodities International LLC ("CCI").

CCI acquires two gas-fired power assets, Rensselaer (NY) and Signal Hill (TX).

CCI acquires Roseton, a dual fuel-fired generation station in New York.

CCI closes on its acquisition of Morgan Stanley’s Global Oil Merchanting business, one of the world’s leading physical oil and products franchises.

CCI acquires certain East Texas assets from Anadarko, making it one of the largest independent gas producers in East Texas.

CCI acquires MaasStroom, a combined cycle power plant located in the Netherlands and acquires a controlling stake in Delta-Energy Group, a green chemical company that converts end-of-life tires into specialty chemicals and recovered carbon black. Tokyo Gas completes a strategic equity investment in CCI’s upstream business, TG Natural Resources (formerly Castleton Resources).

CCI, as part of a JV, acquires a power portfolio from Eversource Energy, rebranding it Granite Shore Power. CCI also acquires NorTex Midstream in Texas and a 50% stake in the Enecogen Power Plant in the Netherlands.

CCI acquires Sherbino I wind farm in Texas, Mt. Storm wind farm in West Virginia and acquires Shell’s Haynesville assets through TG Natural Resources.

CCI acquires a natural gas-fired combined cycle plant in Amorebieta, the Basque Country, Spain and acquires upstream assets in Northern Louisiana through TG Natural Resources, reducing its ownership interest to 27%.

CCI monetizes NorTex Midstream, Mt. Storm wind farm, Sherbino I wind farm and Granite Shore Power. CCI reduces ownership interest in TG Natural Resources to 21%.

CCI acquires a majority stake in S4 Energy BV (Netherlands) and Lower 48 Energy Ltd. (UK), two battery storage owners, operators and developers; and a majority stake in New Salem Harbor (MA), a combined cycle power plant. CCI also monetizes Netherlands Power portfolio.

CCI, through its subsidiary S4 Energy, acquires LC Energy’s battery storage platform (NL), a grid-scale high-voltage battery energy storage systems (BESS) developer, and a portfolio of BESS projects (DE) from Terra One. CCI also acquires Hunlock (PA) power plant.

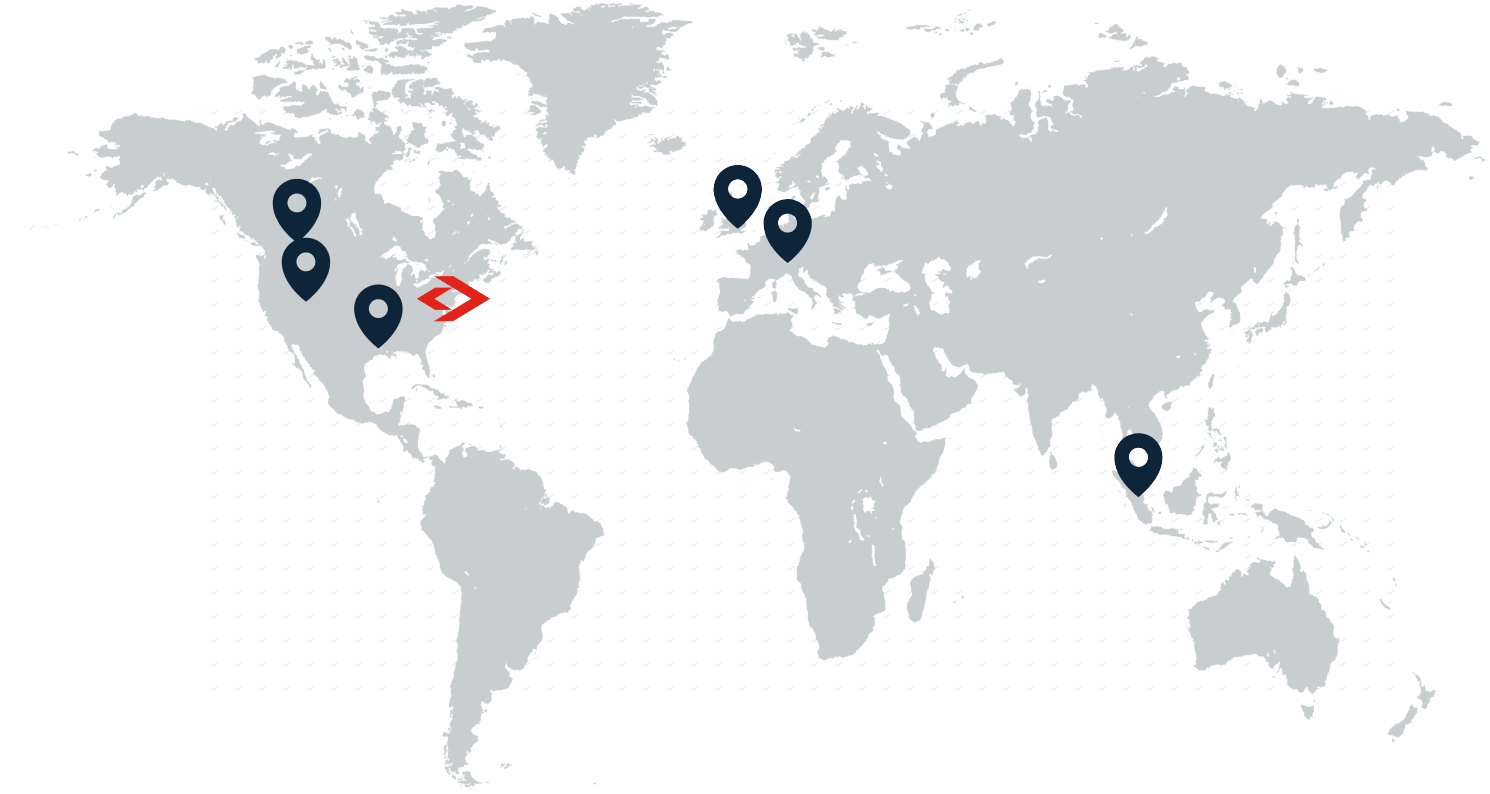

Headquartered in the United States, CCI conducts business around the world.

Learn more